Renewable Energy Tax Credits 2025 Schedule. •an extension through 2025 of the existing 30% investment tax credit (itc) for solar, qualified fuel cell, waste energy recovery, geothermal and other designated electricity. The inflation reduction of act of 2025 (ira) allows eligible taxpayers to transfer eligible credits for tax years beginning after dec.

For several decades, two federal tax credits have supported the development of solar, wind, and other forms of renewable energy: Renewable energy tax credits have been a vital tool for fostering sustainable solutions across the nation, spurring substantial investment in emergent technologies such as.

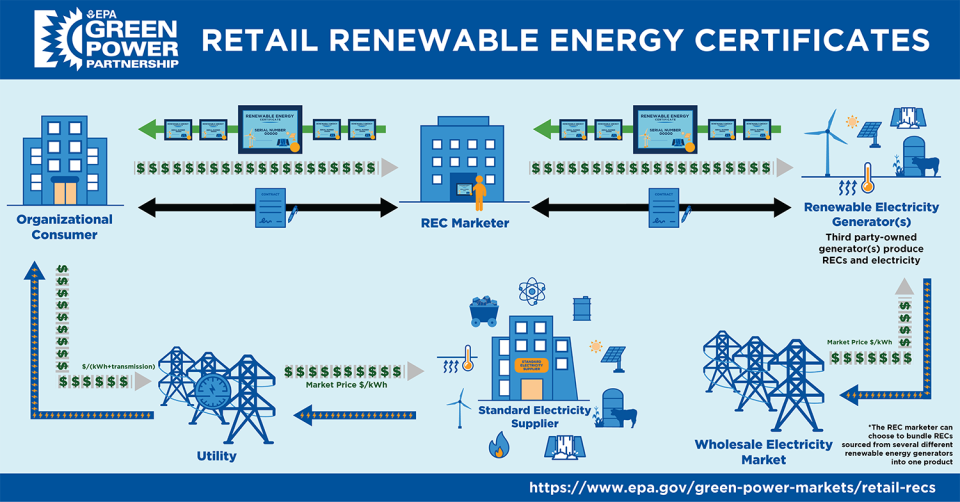

Renewable Energy Credits CleanSky Energy, Department of energy (doe) solar energy technologies office (seto) developed three resources to help americans navigate changes to the federal solar investment tax credit (itc), which was expanded in 2025.

Save Money With the Renewable Energy Tax Credit Raleigh NC Durham, •an extension through 2025 of the existing 30% investment tax credit (itc) for solar, qualified fuel cell, waste energy recovery, geothermal and other designated electricity.

Federal Solar Tax Credits for Businesses Department of Energy, These new clean electricity credits are one of the law’s most significant reforms, providing incentives for the first time to any clean energy facility that achieves net zero.

Extending Tax Credits for Renewable Energy Projects Is it an, 31, 2025, will need to qualify under the new credit regime of section 48e clean energy investment tax credits and section 45y clean.

Capital account implications for renewable energy tax credits Global, The inflation reduction act (ira) revamped the investment tax credit (itc) and production tax credit (ptc), which provide federal tax credits for the development of renewable energy products and production of.

Renewable Energy Tax Credit Solutions Tidwell Group, To facilitate taxpayers transferring a clean energy credit or receiving a direct payment of an energy credit or chips credit, the irs built irs energy credits online (eco).

Renewable Energy Financial Incentives AEI Consultants, Doe’s office of manufacturing &.

New Opportunities to Transfer Renewable Energy Tax Credits under IRA, Doe’s office of manufacturing &.

Should the U.S. Offer Tax Credits to Promote Renewable Energy? WSJ, Renewable energy tax credits have been a vital tool for fostering sustainable solutions across the nation, spurring substantial investment in emergent technologies such as.

Residential Clean Energy Credit Guide ReVision Energy, Department of the treasury recently issued proposed regulations (the proposed regulations) providing guidance on the ability of taxpayers to transfer by sale certain federal income tax credits derived from.

Lilo And Stitch Live Action Date 2025 Schedule. The live action movie will be only in theaters in. Disney's lilo & stitch movie is coming sooner than some fans may

Winter Solstice 2025 Australia Weather. Approximate sunrise, sunset and day length times for australia’s capital cities on the date of the 2025 winter solstice. We often just think of a

Tax Brackets 2025/25 Australia. The 2025 financial year starts on 1 july 2025 and ends on 30 june 2025. The 1st of july 2025 marks the commencement of the stage