Contribution Limit For 529 Plan 2025. 529 plan contributions are fully deductible from. Usually, annual contributions to any individual above a certain threshold ($18,000 in 2025, up from $17,000 in 2025) would count against your lifetime gift tax exemption.

You can contribute as much as you’d like to a 529 plan per year, but there are some caveats. That means an individual can contribute up to $90,000 in a single year to a particular.

In all but four states, there is a limit on the amount of 529 plan contributions eligible for a state income tax break.

Plan Your 2025 Retirement Contributions Velisa Bookkeeping Services LLC, It's also important to think about the new option of 529. 529 plan contribution limits (2025 & 2025) technically, contributions can not exceed the amount necessary to provide for the qualified education expenses of the.

Significant HSA Contribution Limit Increase for 2025, The owner of the roth ira must be the beneficiary of the 529 account, and the 529 plan used must be at least 15 years old before rollovers can occur. When considering the 2025 529 contribution limits, it's important to explore ways to maximize contributions.

nj 529 plan tax benefits Tiffaney Bernal, 529 plan contribution limits (2025 & 2025) technically, contributions can not exceed the amount necessary to provide for the qualified education expenses of the. Review how much you can save for college in these plans.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

Saving for College Strategies for Success, Maximum 529 plan contribution limits by state. In 2025, the annual 529 plan contribution limit rises to $18,000 per contributor.

Must Know 2025 Roth Ira Limits Article 2025 BGH, Nearly every state offers a 529 savings plan, but each sets a maximum contribution limit. One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.

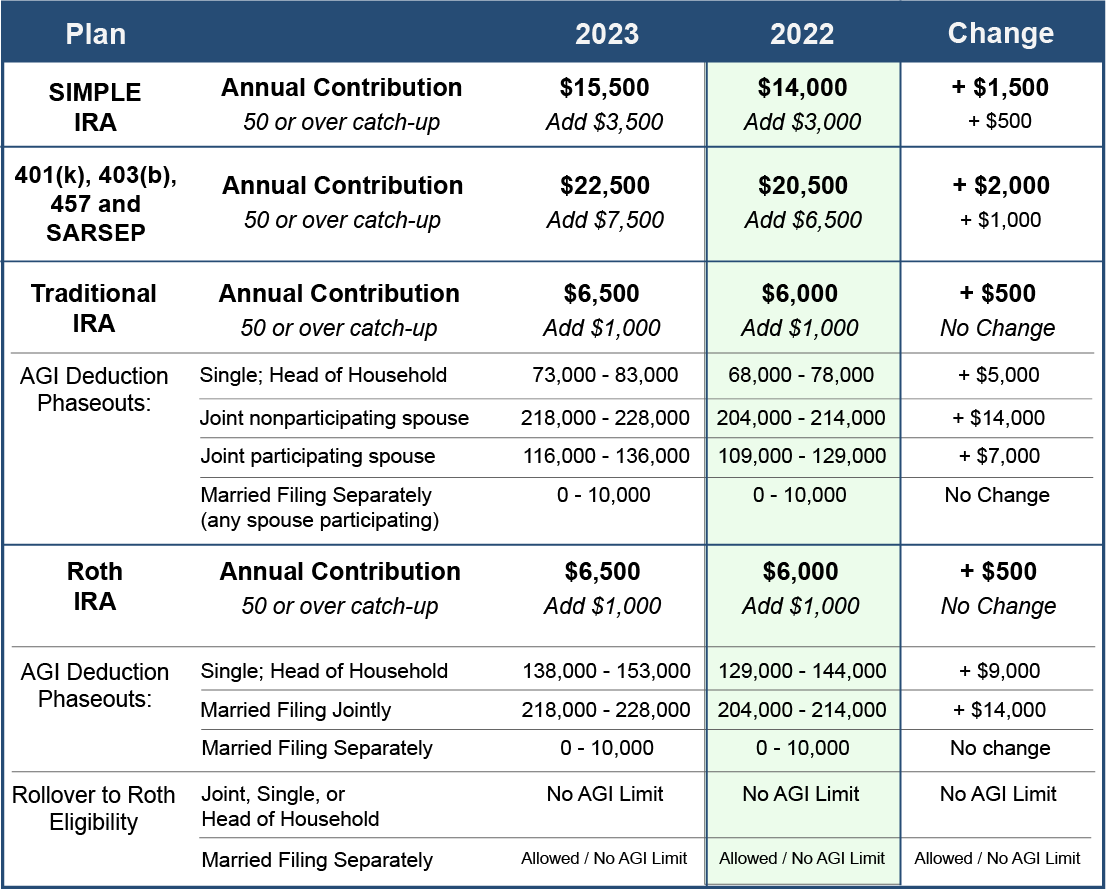

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, 529 plan contributions are fully deductible from. They range from $235,000 to upward of $500,000.

401k 2025 contribution limit chart Choosing Your Gold IRA, In 2025, the annual 529 plan contribution limit rises to $18,000 per contributor. Good news, while there is a maximum aggregate 529 plan contribution limit, there is no annual 529 plan contribution.

2025 Retirement Plan Limits KerberRose Retirement, Unlike retirement accounts, the irs does not impose annual contribution limits on 529 plans. You can fund a 529 plan with up to 5 years’ worth of contributions all at once.

What’s the Maximum 401k Contribution Limit in 2025? (2025), What’s the contribution limit for 529 plans in 2025? Maximum 529 plan contribution limits by state.

529 Plan Contribution Limit 2025 Millennial Investor, When considering the 2025 529 contribution limits, it's important to explore ways to maximize contributions. One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.